fulton county ga sales tax rate 2021

Fulton County collects on average 108 of a propertys assessed. Find your Georgia combined state and local.

Updated Cities Propose Cutting Fulton County S Share Of Sales Tax Revenue In Half Reporter Newspapers Atlanta Intown

Fulton County Sheriffs Tax Sales are held on.

. BOARD OF ASSESSORS Peachtree Center North Tower Main Office 235 Peachtree Street NE Suite 1400 Atlanta GA 30303 Hours of Operation. The current total local sales tax rate in Fulton County GA is 7750. GEORGIA SALES AND USE TAX RATE CHART Effective January 1 2021 Code 000 - The state sales and use tax rate is 4 and is included in the jurisdiction rates below.

The December 2020 total local sales tax rate was also 7750. This is the total of state and county sales tax rates. If your business is based in Atlanta or you sell to customers in.

The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100. 141 Pryor Street SW. Lowest sales tax 6 Highest sales tax 9 Georgia Sales Tax.

Sales Tax - Upcoming Quarterly Rate Changes. Upcoming quarterly rate changes. The minimum combined 2022 sales tax rate for Fulton County Georgia is.

Average Sales Tax With Local. The base state sales tax rate in Georgia is 4. The minimum combined 2022 sales tax rate for Fulton County Georgia is.

What is the sales tax rate in Fulton County. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. Fulton County has one of the highest median property taxes in the United States and is ranked 220th.

Local tax rates in Georgia range from 0 to 5 making the sales tax range in Georgia 4 to 9. Georgia has state sales. The Atlanta Georgia sales tax is 890 consisting of 400 Georgia state sales tax and 490 Atlanta local sales taxesThe local sales tax consists of a 300 county sales tax a 150 city.

Monday-Friday 8am-430pm Fulton County. The 89 sales tax rate in Atlanta consists of 4 Georgia state sales tax 3 Fulton County sales tax 15 Atlanta tax and 04 Special taxThe sales tax jurisdiction name is Atlanta Tsplost Tl. 707 rows 2022 List of Georgia Local Sales Tax Rates.

OFfice of the Tax Commissioner. Rate Changes Effective October 1 2022 1627 KB Rate Changes Effective July 1 2022 1113. The total 775 Fulton County sales tax rate is only applicable to businesses and sellers that are not in the Greater Atlanta area.

The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax. GA Rates Calculator Table. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER.

2020 rates included for use while preparing your income tax deduction. Bidders must register each month for the Tax Sale. Fulton County has one of the highest median property taxes in the United States and is.

The 1 MOST does not apply to sales of. Fultons rate inside Atlanta is 3. Fulton County collects on average 108 of a propertys assessed fair market value as property tax.

This rate includes any state county city and local sales taxes. Fulton County at Maxwell Road 11575 Maxwell Road Alpharetta Georgia 30022 North Fulton Service Center 7741 Roswell Road NE Suite 210 Atlanta Georgia 30350 South Fulton Service. The total sales tax rate in any given location can be broken down into state county city and special district rates.

GEORGIA SALES AND USE TAX RATE CHART Effective July 1 2021 Code 000 - The state sales and use tax rate is 4 and is included in the jurisdiction rates below. Winning Bidder- Upon the conclusion of the Tax Sale the winning bidder will come back within 1 hour to 185 Central Ave. Georgia has a 4 sales tax and Fulton County collects an additional 3.

What Is The Fulton County Sales Tax The Base Rate In Georgia Is 4

City Of Roswell Property Taxes Roswell Ga

Georgia Sales Tax Guide And Calculator 2022 Taxjar

Top 10 Housing Markets Most And Least Affordable In Q3 2022 Attom

Free Georgia Motor Vehicle Bill Of Sale Form T 7 Pdf Eforms

No Runoff Election In Alpharetta

Georgia Income Tax Calculator Smartasset

Georgia Sales Tax Rates And Compliance Agile Consulting

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Fulton County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Property Taxes By County Interactive Map Tax Foundation

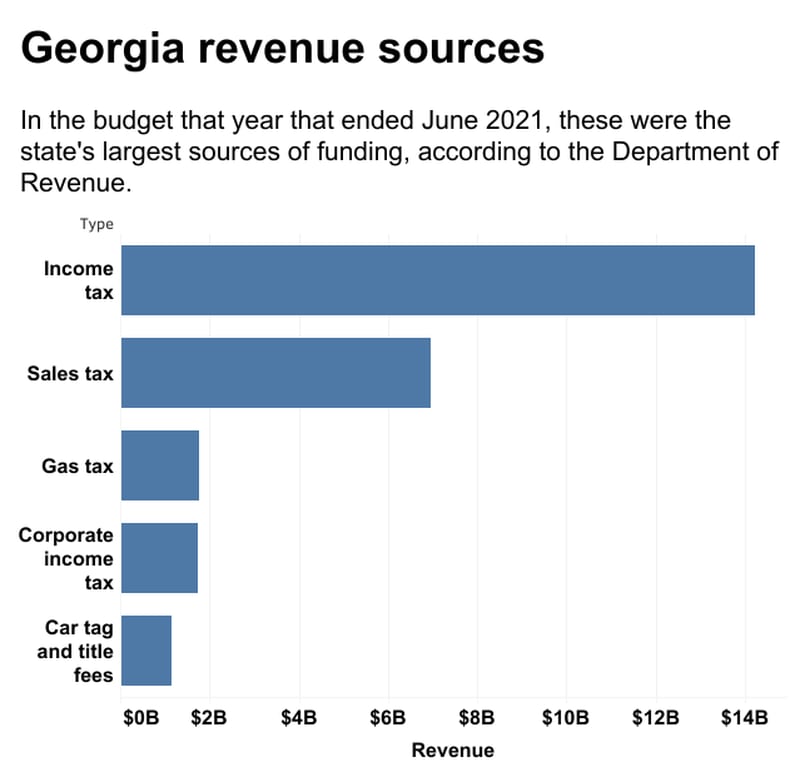

Gop Hopefuls In 2022 Want To Eliminate Georgia Income Tax

Development Authority Of Fulton County Ga Home

Construction Contractors Georgia Sales And Use Tax Obligations Litwin Law

Atlanta Sales Tax Services Williams Accounting Consulting

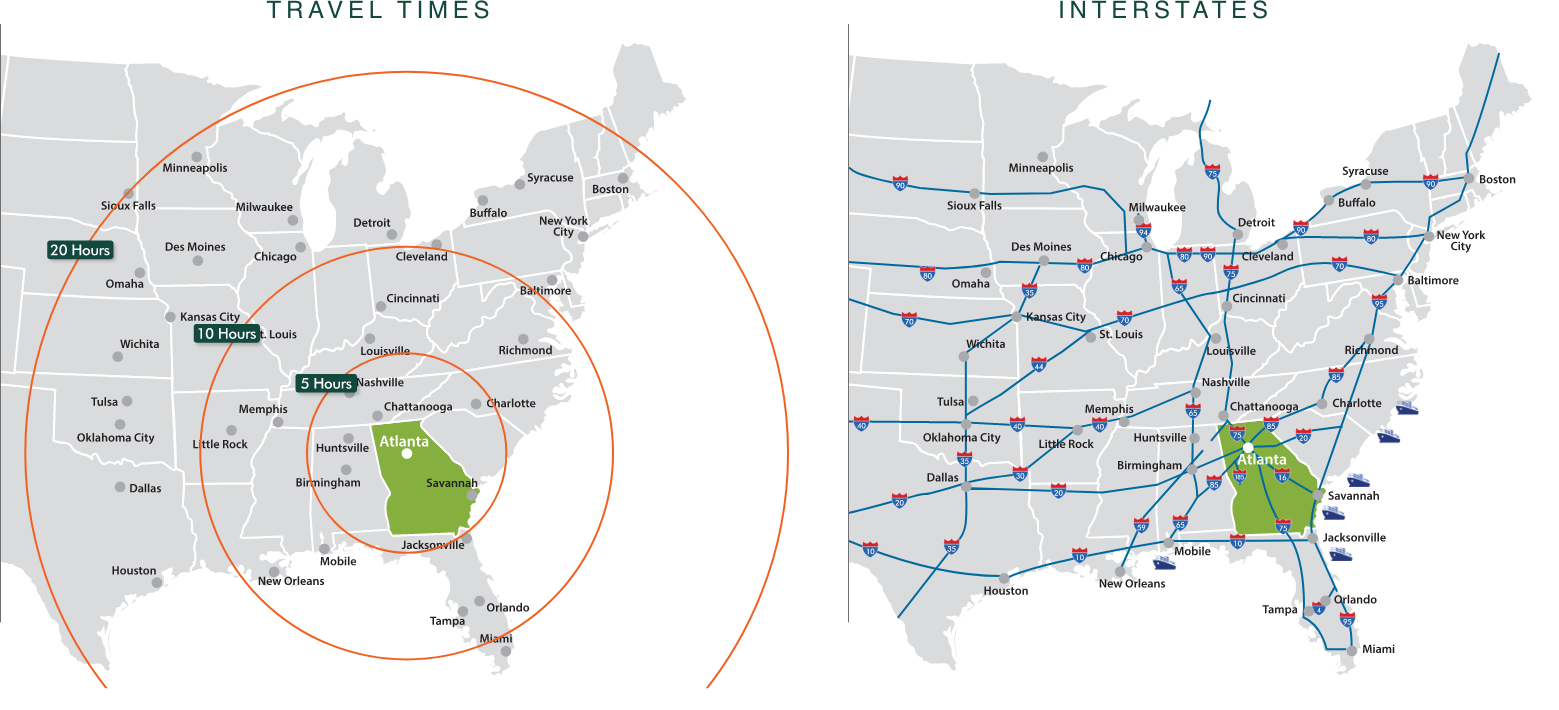

Profile Of Metro Atlanta Metro Atlanta Demographics Overview

Construction Contractors Georgia Sales And Use Tax Obligations Litwin Law